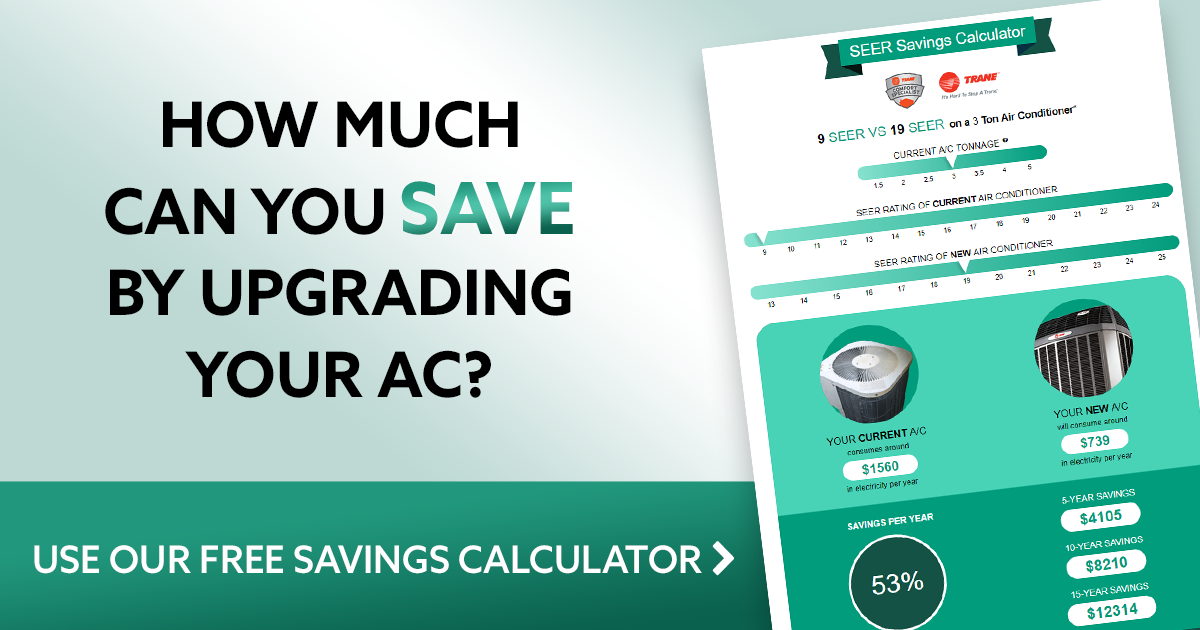

So making smart decisions about your home s heating ventilating and air conditioning hvac system can have a big effect on your utility bills and your comfort.

Air conditioner seer rating tax credit.

Seer stands for seasonal energy efficiency ratio commonly referred to incorrectly as seasonal energy efficiency rating a seer rating is the ratio of the cooling output of an air conditioner over a typical cooling season divided by the energy it consumed in watt hours.

Air source heat pumps.

Packaged systems must have a seer seasonal energy efficiency ratio of greater than or.

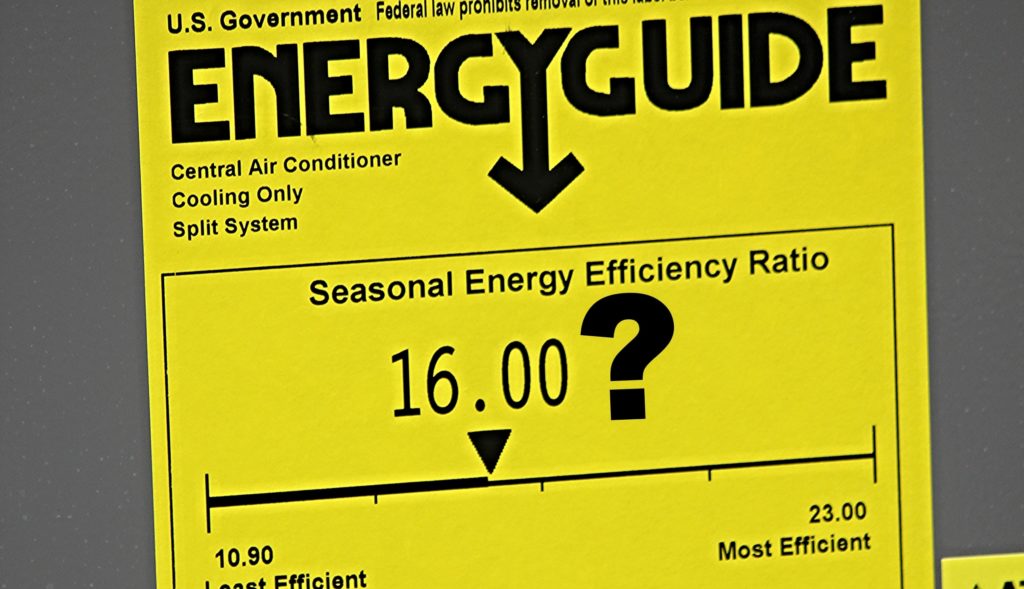

With seer 16 and eer 13 or package systems with seer 14 and eer 12.

Seer 16 eer 13.

To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for the equipment you plan to purchase.

300 for split systems.

Split systems must have a seer seasonal energy efficiency ratio of greater than or equal to 16 and an eer energy efficiency ratio of greater than or equal to 13.

The tax credit is for 300.

Qualifying air conditioning systems.

300 credit for stoves with an efficiency of 75.

50 for fans that use less than 2 of a furnaces energy.

Seer 14 eer 12.

The criteria for qualifying for that tax credit is that the system must meet certain energy efficiency guidelines.

Hvac air circulating fan.

Having the opportunity to claim a tax credit on your taxes when you install a qualifying air conditioning system is a great way to reduce the cost of this large investment.

Air conditioners recognized as energy star most efficient meet the requirements for this tax credit.

Hspf 8 5 eer 12 5.

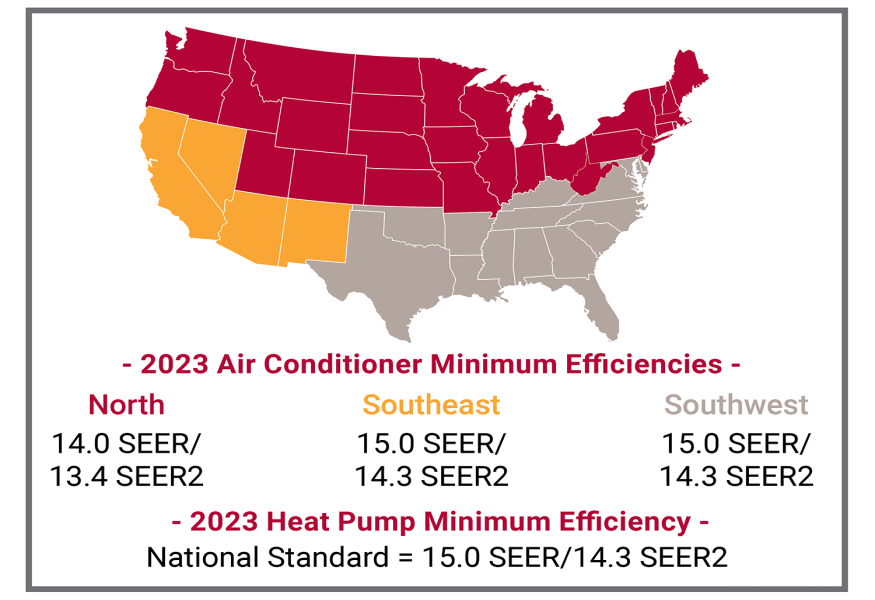

A cooling efficiency of greater than or equal to 14 seer and 12 eer.

Eer 12 and seer 14.

Certain heat pumps also qualify for a tax credit of 300.

Matched with a correct indoor coil and or furnace to achieve the energy efficiency criteria required to qualify for the tax credit.

Air conditioners meeting the following requirements are eligible for a 300 tax credit.

In order to receive a tax credit of 300 the air conditioning system must meet the following criteria.

Air conditioners and air conditioner coils and select yes for eligible for federal tax.

A cooling efficiency of greater than or equal to 15 seer 12 5 eer or higher and a heating.

Split system air conditioning must meet 25c requirements of 16 seer 13 eer both efficiency levels must be met to qualify for the tax credit manufacturer s certificate split system heat pump must meet 25c requirements of 15 seer 12 5 eer 8 5 hspf all three efficiency levels must be met to qualify for the tax credit manufacturer s certificate.

Seer 16 eer 13 package systems.

They must meet the following criteria.

Gas propane or oil hot water boiler.

300 requirements split systems.